Oregon House Bills 2007 and 2415 to Affect Contractors

Mon Jul 15, 2019

On July 3, 2019, the Oregon legislature passed House Bill 2007, which created new requirements for diesel engines for Washington, Clackamas, and Multnomah County. They also passed House Bill 2415, which requires contracting agencies, owners, contractors, and subcontractors to hold retainage in interest bearing accounts, which Governor Brown signed into law on June 25, 2019.

House Bill 2007

Vehicle Registration Restrictions

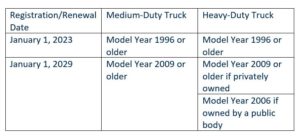

House Bill 2007 allocates funds from the Volkswagen Environmental Mitigation Trust Agreement that states are entitled to as a result of the Volkswagen diesel emissions scandal. House Bill 2007 phases in new registration and registration renewal limits for medium-duty and heavy-duty diesel-engine trucks. Below is a table identifying the date after which Multnomah, Clackamas, and Washington counties cannot issue registration or renew of registration:

In addition, as of January 1, 2025, Multnomah, Clackamas, and Washington counties cannot issue a certificate of title if the vehicle is a medium-duty truck model year 2009 or older or if the vehicle is a heavy-duty truck model year 2006 or older.

House Bill 2007 specifically exempts certain vehicles from the definitions of medium-duty and heavy-duty truck:

- Farm tractors

- Farm vehicles

- Training vehicles

- Emergency vehicles (publicly and privately owned)

- Ambulances

- Campers

- Motor Homes

- Recreational Vehicles

- Heavy-duty trucks operated for 5,000 miles or fewer on highways in Oregon during a calendar year

- Logging trucks

- Carriers with a fleet of five or fewer heavy-duty trucks

- Antique vehicles

Retrofitting and Grant Support

However, House Bill 2007 is not all bad news. The restrictions on registration and renewal can be lifted if the owner has proof of certification that the diesel engine has been retrofitted to comply with rules the Environmental Quality Commission will create in accordance with Section 7 of House Bill 2007. It also will give grants to public school bus contractors, disadvantaged business enterprises, minority-owned businesses, women-owned businesses, businesses owned by service-disabled veterans or emerging small businesses to assist them with transitioning their fleets to clean diesel. Grants will also be available for the retrofit of concrete mixer trucks or trucks that are used for transporting aggregate. House Bill 2007 again gives authority to the Environmental Quality Commission to adopt rules to implement the grants.

Voluntary Emissions Control Label Program

House Bill 2007 also includes a new Voluntary Emissions Control Label Program that allows owners and operators of diesel engine construction equipment to receive and display an emission control label on the equipment. The benefit to the participants of this program is not clear as it is a voluntary program that requires a fee to participate but there is no corresponding credit from the State for participating.

Clean Diesel in Public Contracts

House Bill 2007 also institutes new public policy requiring “clean diesel” in public contracts. Starting January 1, 2022, for public projects valued at $20 million or more issued by a state contracting agency for a public improvement located in Multnomah, Clackamas, or Washington counties, the solicitation will require at least 80 percent of the diesel engine motor vehicles be model year 2010 or newer diesel engines. 80 percent of the nonroad diesel engines must meet or exceed United States Environmental Protection Agency Tier 4 exhaust emission standards.

This “clean diesel” requirement will immediately apply to the Interstate 5 Rose Quarter Project, the Interstate 205 Abernethy Bridge Project, the Interstate 205 Freeway Widening Project, the State Highway 217 Northbound Project and the State Highway 217 Southbound Project.

House Bill 2415: Prompt Payment Policy and Partial Payment Statute Update

House Bill 2415 is a minor, but important, change to Oregon’s public and private Prompt Payment requirements. Starting January 1, 2020, if the contract price exceeds $500,000, the contracting agency, private owner, contractor, or subcontractor must place amounts deducted as retainage into an interest-bearing escrow account. The interest will run from the date the payment request is approved until the date the retainage is paid to the party to which the retainage is due.

Previously, the contracting agency, owner, contractor, or subcontractor were required to pay interest on an invoice 30 days after receipt or 15 days after approval of the invoice, whichever was earlier. However, this requirement did not include interest on retainage amounts that were properly withheld. Now those retainage amounts will need to be transferred to interest-bearing accounts rather than simply withheld.

Alix Town is an attorney in the firm’s Seattle office where she frequently represents owners, general contractors and subcontractors on a broad range of federal, state, and local government contracts and related litigation matters including contract formation and administration matters, government investigations, and contract claims and disputes.

Sign up for News & Events

Sign up for News & Events